will capital gains tax rate change in 2021

Short-term gains are taxed as ordinary income. There is a change on the horizon which can take place as soon as 2022.

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Long-term capital gains taxes are assessed if you sell investments at a profit after owning them for more than a year.

. The rates do not stop there. Long-term capital gains are. As a business seller if you are in either the low or mid earning bracket any proposed changes will not affect you so proceed with the sale of.

Discover Helpful Information and Resources on Taxes From AARP. Joe Biden says this tax increase funds a 18 trillion dollar. Capital Gains Tax.

Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. Over the last year there has been considerable speculation like most other things these days about the Federal Government increasing the inclusion rate of capital gains tax in Canada.

Tom talks all things capital gains tax rates in this weeks podcast. There are exceptions to this such as when it was 15 from 2004 to 2012. Another would raise the capital gains tax rate to 396 for taxpayers.

For assets held less than one year short-term gains are taxed at regular income rates which may be as high as 34 based on the taxpayers individual income. 4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. When the additional tax on NII is factored in investors earning 1 million or more could actually see their tax rate on capital gains jump to 434.

Assets other than stocks may have different rates for capital gains taxes. In 2020 the more income you make the higher capital gains tax rate you pay as well. House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci.

Historically capital gains tax has sat around 20. Ad Compare Your 2022 Tax Bracket vs. For investors who make 1 million or more who are already taxed a surtax on investment income this change could mean their federal tax responsibility could be as high as 434.

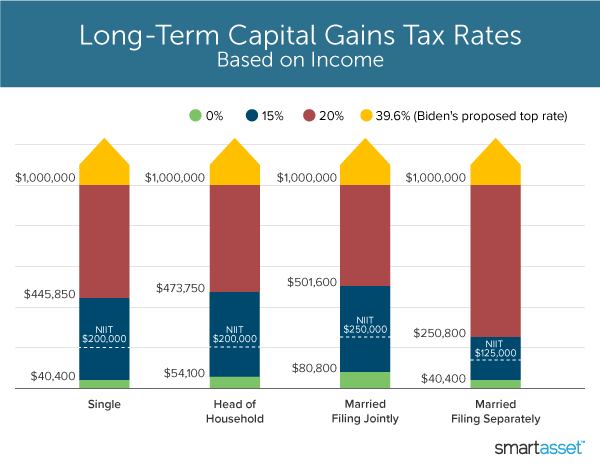

You will be taxed at your ordinary income tax rate on short-term capital gains. The tables below show marginal tax rates. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. The CGT rate is currently 20 28 for disposal of residential property or carried interest. The current long-term capital gains tax rates are 15 20 or 238 for higher income taxpayers.

He covers common misconceptions regarding capital gains taxes. Currently the capital gains tax rate for wealthy investors sits at 20. For 2020 and 2021 the long-term capital gains rates are as follows.

Your 2021 Tax Bracket to See Whats Been Adjusted. Short-term capital assets are taxed at your ordinary income tax rate up to 37 for 2022. 7 rows 2021 federal capital gains tax rates.

The 20202021 capital gains tax rates and taxpayer income levels sorted by filing status. Although the concept of capital gains tax is not new to Canadians there have been several. If you sell small-business stocks or collectibles the maximum.

The proposal is bumping this up to 396. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes. Possible Changes Coming to Tax on Capital Gains in Canada.

Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a. While the way capital gains taxes are treated may change in 2021 those who had previously been in either the 0 or 15 categories will likely see no change. We were anticipating changes to the Capital Gains Tax CGT rates due to the Office of Tax Simplification report from last year so it was good news to hear that the regime remains unchanged going into the 202122 UK tax year.

4 rows The proposal would increase the maximum stated capital gain rate from 20 to 25. Depending on how long you hold your capital asset determines the amount of tax you will pay. Now that 2021s tax deadline has passed its time to start looking for changes to make as we head further into 2022.

One of the proposals Congress is considering sets the top rate for taxing capital gains at 25 up from 20 under current law. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35. This tax change is targeted to fund a 18 trillion American Families Plan.

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

2022 And 2021 Capital Gains Tax Rates Smartasset

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Definition 2021 Tax Rates And Examples

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

2022 And 2021 Capital Gains Tax Rates Smartasset

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Capital Gains Definition 2021 Tax Rates And Examples

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Definition 2021 Tax Rates And Examples

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)